WE FIGHT TO WIN!

North Carolina’s Unauthorized Substance Tax Program

Taxes on illegal substances have at some point been enacted in over half the states. The taxes generate funding for law enforcement and place civil tax liability on individuals in possession of the requisite amount of illegal substances.

North Carolina’s Unauthorized Substance Tax, has collected over $135 million in funds from taxing confiscated illegal substances since 1990. About $50 million of this amount has been collected within the past five years.

The Unauthorized Substance Tax is a type of excise tax in North Carolina, which normally means it is a tax paid when purchase is made on a particular good or activity. The program, however, frequently collects the tax by garnishing wages, seizing bank accounts and auctioning off the personal assets (such as cars, motorcycles, boats, electronics or jewelry) that the person may have been able to keep otherwise.

What is the Unauthorized Substance Tax Program?The state-run program allows taxpayers to confidentially buy “revenue stamps,” commonly called “drug stamps,” through the Department of Revenue. As an excise tax, the unauthorized substance tax is technically due when the person obtains the illegal substance, or within 48 hours after.

Information the department obtains from the drug stamp program is not disclosed to or used in criminal prosecutions against the people that apply for them (other than for a prosecution for violation of the tax law). Dealers are not required to provide their names, addresses, social security numbers, or any other identifying information to receive the stamps. The stamps may be issued and their taxes paid either in person or by mail.

The dealer is then supposed to permanently attach the stamps to the illegal substance. The tax only has to be paid once per each particular substance; for example, if a dealer pays taxes to receive stamps for two bricks of cocaine, those two particular bricks will not need to have taxes paid on them again, even if they change hands to another dealer, as long as the stamps remain affixed to them.

A Department of Revenue employee who shares a stamp purchaser’s information with law enforcement is actually guilty of a Class 1 misdemeanor.

To Whom Does the Unauthorized Substance Tax Program Apply?The program applies to anyone who qualifies as a “dealer” under the program. A “dealer” under North Carolina’s Unauthorized Substance Tax Program is defined as someone who possesses more than 42.5 grams of marijuana (or 1.5 ounces, the cutoff amount that enhances marijuana possession from a misdemeanor offense to a felony here under N.C.G.S. 90-95(d)(4)); at least seven grams of any other controlled substance sold by weight; or at least 10 dosage units of any other controlled substance that is not sold by weight. Possession of illegal alcohol for sale or moonshine also qualifies a person as a dealer under the tax program.

Can the Fact that I Participated in the Revenue Stamp Program before a Criminal Arrest Help my Case?No. The program does not absolve a person from or mitigate their criminal liability. It only helps individuals avoid civil tax obligations. A person would still be in violation of North Carolina’s criminal statutes for trafficking or possessing the illegal substance.

If a person did not participate in the revenue stamp program ahead of their related criminal arrest (which is often, as people are still wary of the program’s actual secrecy), the Unauthorized Substance Tax Program operates by holding the person civilly liable for the requisite amount of taxes they would have paid in revenue stamps. If the person cannot afford to pay the stamps, the government can garnish the person’s wages and seize their bank accounts and property in order to force the payment of the taxes. This creates yet an additional hurdle that the now-criminally-accused person must face.

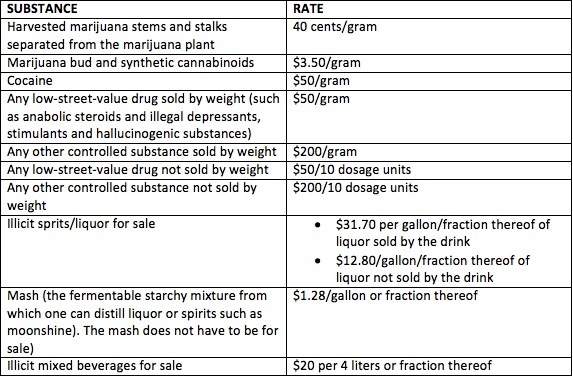

What are the Tax Rates for the Program?As of 2016, the rates for the Unauthorized Substance Tax Program are as follows.

If you are being charged with a crime or think the Unauthorized Substance Tax Program could potentially affect you, it is extremely important to speak with an experienced local criminal defense attorney. Arnold & Smith, PLLC is a criminal and civil litigation firm based in Charlotte, North Carolina that serves our clients with the utmost dedication and skill. Our defense attorneys fight for the rights of our clients in the North Carolina court system almost every day for a variety of drug charges and other criminal matters. Contact us today for an initial consultation with one of our criminal defense attorneys about your case.

Charlotte Criminal Defense Lawyers Arnold & Smith Home

Charlotte Criminal Defense Lawyers Arnold & Smith Home